PALICO, THE PE MARKETPLACE

For Secondary Sellers

We provide investors seeking liquidity for their LP stakes access to motivated secondary buyers — all within a standardized process

As FEATURED IN

a few figures about

the Palico secondary marketplace

Secondary buyer firms present on the platform

Of secondary capital represented in the Palico marketplace

Non-traditional buyers with more joining each week

A Dynamic Platform

For Dedicated Sellers

STEP ONE

SALE PREP

Our purpose-built platform allows sellers to quickly set up a sale with the key information needed for buyers to evaluate. Guidance is provided on what data room documents are necessary.

STEP two

NDA & DILIGENCE

STEP three

MONITOR BUYERS ANONYMOUSLY

Sellers can use the encrypted chat drawer to track who has received and signed NDAs in addition to facilitating direct conversations and file exchanges with buyers. All while remaining anonymous in the process.

STEP four

BIDDING & SELECTION

The aha moment! Buyers start submitting non-binding and binding bids. Quickly review all bids in order to decide which buyer(s) to move forward with in the process.

STEP FIVE

Finalize transaction

Once the seller selects the winning buyer/bid, the deal goes offline for execution of legalese regarding fund ownership transfer in exchange for cash. At this point the seller identity will be disclosed to the buyer for the first time.

Access to A leading

BUYER BASE

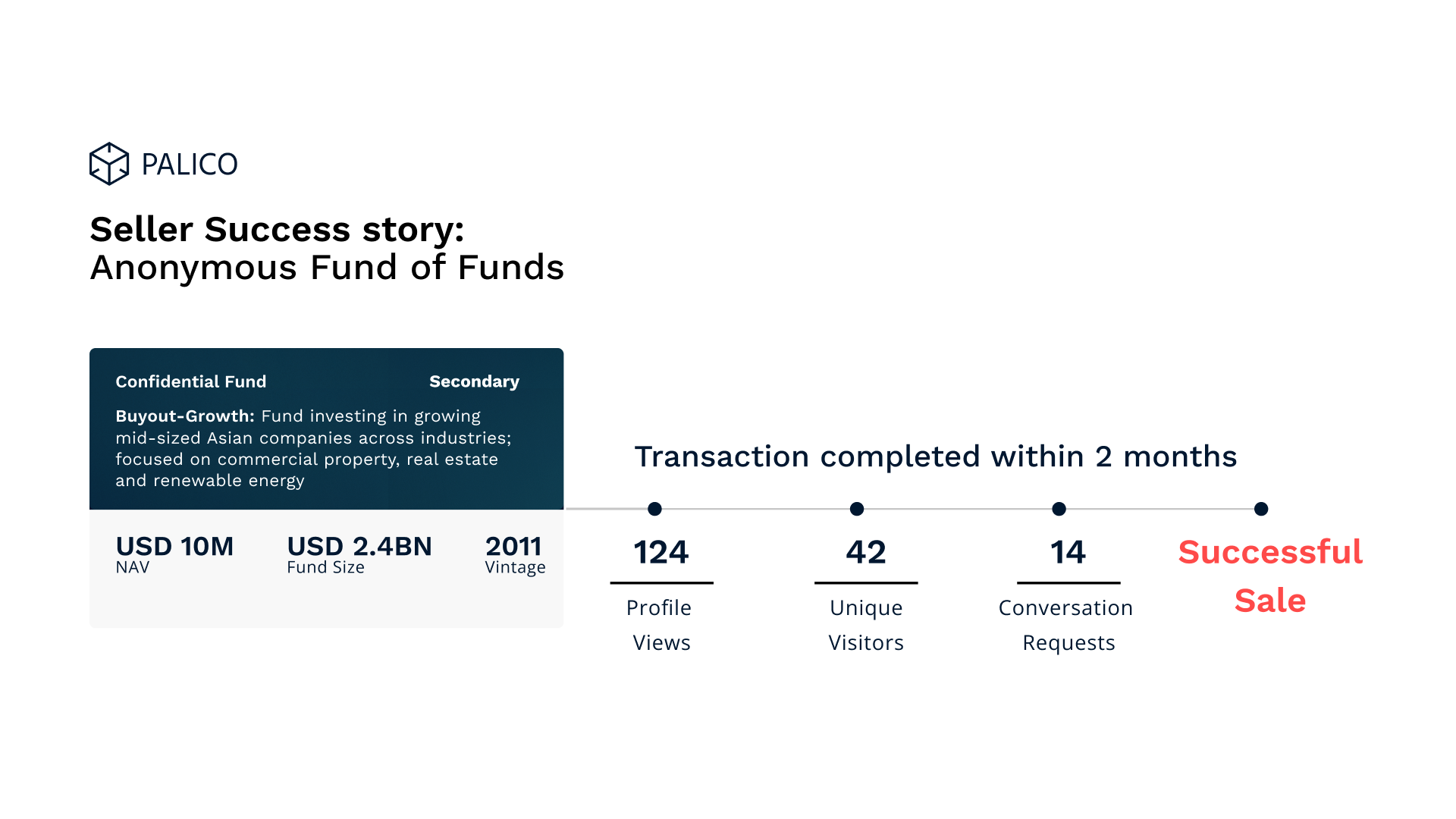

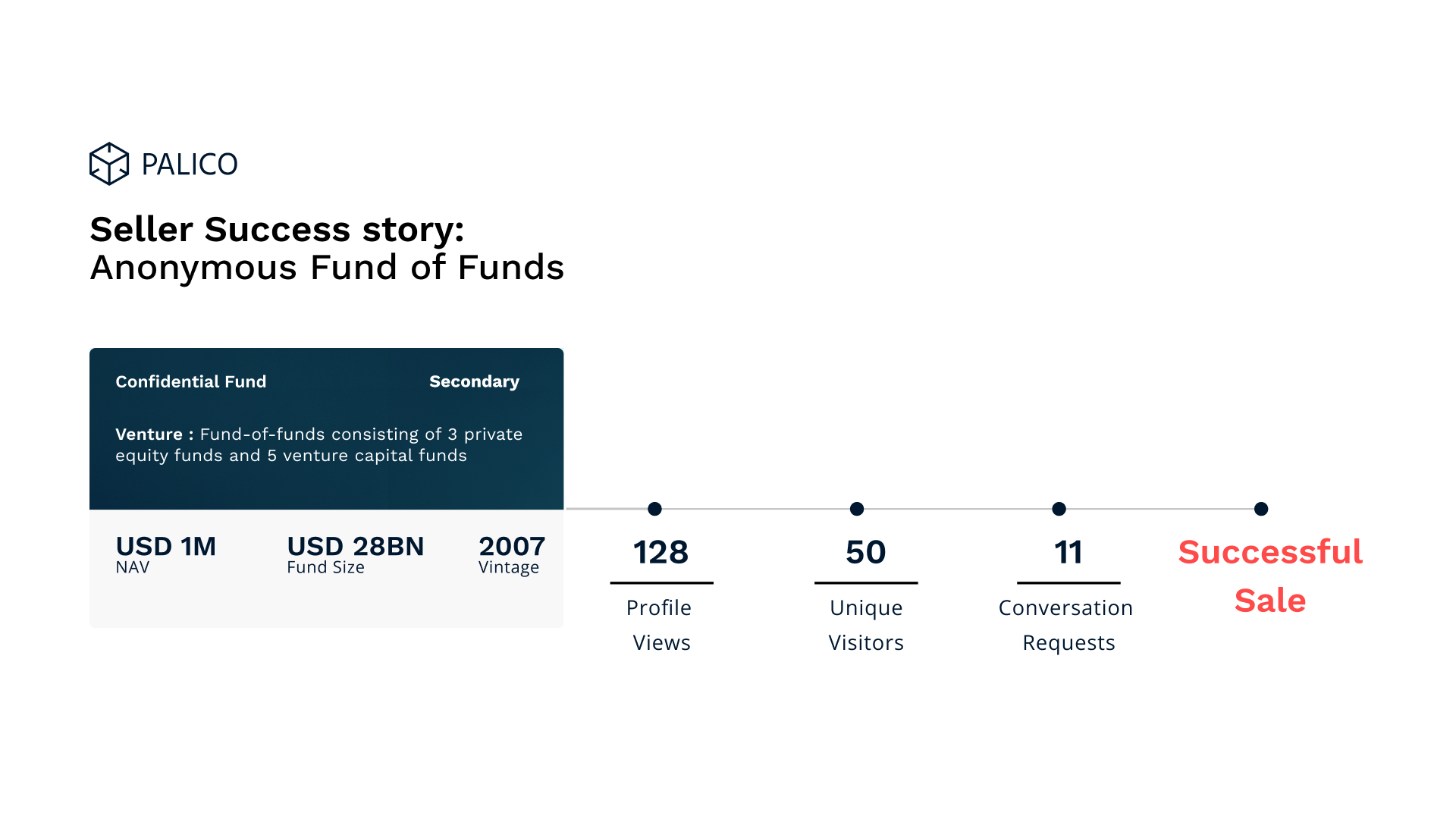

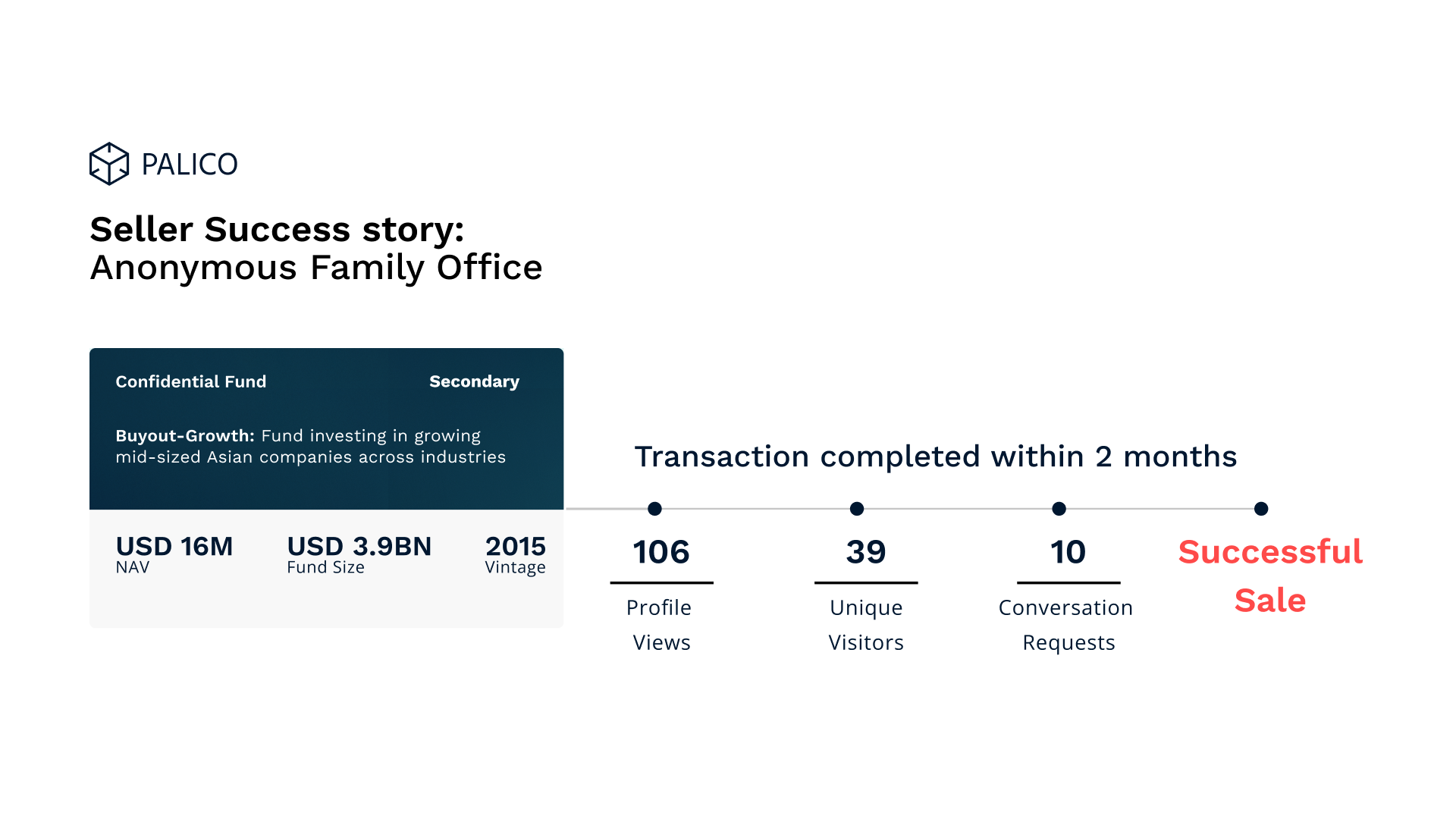

Secondary

SUCCESS STORIES

Reasons to sell

on the Secondary Market

Liquidity Needs

Provide optionality for any investor seeking contingent or recurring cash to maintain a minimum buffer of liquid assets.

Portfolio Management

Continue to align with internal guidelines and offset the denominator effect by rebalancing portfolios and restoring target weightings.

Relationship Management

Maintain strong relationships by optimizing exposure for GPs while reducing concentration risk and assist in financing stake acquisitions in other funds.

Dedicated to Sellers

Palico assists secondary sellers with a no-cost, no obligation to sell platform and ensures seller anonymity with all listings.

What our secondary marketplace users

have been saying

Unigestion

Flashpoint

Catalus Capital

Multiplicity Partners

VCFA

WM Partners

Bee Alternatives

Decalia

“Palico has made it so that in just a few clicks you can source secondary transactions and deal flow that are relevant to you.”

“We generated interest from 3 different LPs within one week – Like most GPs, we are a small team and we do not have enough staff to actively seek out buyers. The Palico platform allowed us to list our secondary stake in a straightforward and fast manner, and engage with buyers in a secure digital environment.”

“We at Catalus Capital have found Palico to be an innovative platform helping us source differentiated investment opportunities. The Palico team is continually pushing the boundaries of applying technology to improve the liquidity of private capital.”

“We like that you [Palico] help the smaller end of the market to get secondary market liquidity. Most private market investors don’t hold positions in the hundreds of millions and hence don’t get serviced by the larger advisory firms. There was clearly a gap in the secondary market where Palico now plays an important role.”

“We like Palico as a discovery tool as it has allowed us to learn about new funds we have never crossed before. This is especially useful for us as a small team — to have access to & explore a wide range of opportunities, all on one platform.”

“We applaud Palico’s approach and achievement in developing the effective digital solution to match the buyers and sellers with smaller size transactions, where there is an obvious gap in the market. The UI/UX design of the platform is very impressive. Not to mention that the team of Palico is very professional and dedicated to supporting each transaction.”

“Palico and its team understand the needs of professional secondary buyers like us well, and as such have created an intuitive platform and a smooth experience. Since being on the platform, we have been introduced to interesting and consistent deal flows on Palico, including from our focus area in Asia.”

“Palico has developed a very useful platform, with a smooth user experience and a growing inventory of opportunities, to match buyers and sellers in secondaries transactions that otherwise might not get done in a traditional process.”

Eric Marchand, Head of APAC Private Equity

Igor Bilous, Managing Partner of Flashpoint

Marek J. Olszewski, Managing Partner Catalus Capital

Andres Hefti, Partner at Multiplicity Partners

David Tom, Co-Managing Partner VCFA

Tokyo-based Growth & PE Secondary Investment Firm

Yuliang Chen, Founding Partner of Bee Alternatives

Reji Vettasseri - Lead Portfolio Manager Private Markets Funds and Mandates

FAQ

Who should use Palico's Secondary Marketplace?

Palico’s platform can host all types of secondary fund sales, and therefore, any Private Equity fund investor looking to sell their Private Equity fund stake will be able to leverage the platform. However, Palico’s marketplace specializes in smaller fund stakes (of roughly $20M in NAV or below).

As a result of their transaction size, smaller stakes have traditionally experienced limited access to a competitive bidding process or general liquidity.

- Competitive Bidding Process: small secondary sellers benefit from a global marketplace featuring secondary buyers ranging from large secondary funds to smaller secondary specialists.

- Secure Virtual Data Room: our platform is designed with a fully encrypted data room and messaging module, allowing you to display sensitive information and engage in secure conversations.

- Seller Anonymity: the seller always remains anonymous when listing the fund stake for sale. The seller is only obligated to reveal themselves to the buyer when accepting bids from interested buyers.

- No Obligation to Sell: there is no obligation to sell — the seller can close their listing at any time without any fees or penalty.

- Streamlined Process: our platform provides digital tools that streamline the various stages of the sales process including data room set up, non-binding bids and binding bids.

- Comprehensive Customer Service: every secondary sales transaction is assigned to a dedicated Palico PE account services individual to assist throughout the process. Email, call, or message us – we aim to provide a premium customer experience.

What kind of fund stakes can be sold on Palico’s Secondary Marketplace?

- Single LP stakes

- Portfolio of LP fund stakes

- Co-investment opportunities (case by case basis)

- Fund stakes ranging from $1-100M (exceptions can apply)

How Does Palico's Secondary Marketplace Work?

What documents do I need to facilitate the sale?

We recommend having the following documents listed below to optimize the sales process:

Mandatory documents:

- Quarterly Report

- Financial Statements

- Capital Account Statement

Additional documents:

- Subscription Agreement

- Limited Partnership Agreement (LPA)

- Private Placement Memorandum (PPM)

Secondary buyers have the option to browse any secondary sales opportunities listed on the platform. Once an opportunity of interest is identified, the buyer can then request access to the sellers virtual data room to review documents to reach the seller through Palico’s encrypted messaging module.

- Term Sheet

- Sales and Purchase Agreement

- Transfer Agreement

While legal paperwork will be finalized offline, supplemental documents may be hosted in Palico’s virtual data room as needed.

Security / Data Protection

Palico’s platform combines technological excellence along with regulatory compliance. We continuously improve the platform to ensure the security and confidentiality for all of our users.

Security and Data Protection:

Palico is a cloud-based platform and complies with the industry-standard data security protocols. Our network and infrastructure use several security layers (encryption, authentication, authorization) to guarantee the confidentiality and integrity of all recorded and exchanged data. All security layers are based on widely used and approved protocols in the industry and comply with ISO 27001 certification.

Confidentiality:

Palico offers a virtual data room to share confidential information with selected counterparties. The data room’s access is granted by the seller (in the case of a secondary sale) or by the GP (in the case of fundraising) for chosen requesters.

Palico also provides an end-to-end encrypted messaging module in order to negotiate and discuss transaction details privately.

Anonymity:

Palico is designed to maintain the anonymity of all LP members on the platform:

- Palico respects the LP’s preference to remain anonymous on the platform.

- At the sellers discretion, their identity can be kept confidential up until the LOI stage.

- In the event the LP selling a secondary fund stake the identity of the seller is kept confidential at the discretion of the LP but does have an obligation to reveal their identity once the process gets to the LOI stage of a secondary sale.

Fairness:

The marketplace is controlled and overseen by our internal compliance team. The compliance team thoroughly monitors member activity to ensure that no member is misusing the information available online.

Transparency and Standardization:

Palico is built on the premise of providing a level-playing field to all its members on the platform. It does so by giving all its members’ access to the same information presented in a standardized form for all investment or sale opportunities available on the marketplace

FAQ

Who should use Palico's Secondary Marketplace?

Palico’s platform can host all types of secondary fund sales, and therefore, any Private Equity fund investor looking to sell their Private Equity fund stake will be able to leverage the platform. However, Palico’s marketplace specializes in smaller fund stakes (of roughly $20M in NAV or below).

As a result of their transaction size, smaller stakes have traditionally experienced limited access to a competitive bidding process or general liquidity.

- Competitive Bidding Process: small secondary sellers benefit from a global marketplace featuring secondary buyers ranging from large secondary funds to smaller secondary specialists.

- Secure Virtual Data Room: our platform is designed with a fully encrypted data room and messaging module, allowing you to display sensitive information and engage in secure conversations.

- Seller Anonymity: the seller always remains anonymous when listing the fund stake for sale. The seller is only obligated to reveal themselves to the buyer when accepting bids from interested buyers.

- No Obligation to Sell: there is no obligation to sell — the seller can close their listing at any time without any fees or penalty.

- Streamlined Process: our platform provides digital tools that streamline the various stages of the sales process including data room set up, non-binding bids and binding bids.

- Comprehensive Customer Service: every secondary sales transaction is assigned to a dedicated Palico PE account services individual to assist throughout the process. Email, call, or message us – we aim to provide a premium customer experience.

What kind of fund stakes can be sold on Palico’s Secondary Marketplace?

- Single LP stakes

- Portfolio of LP fund stakes

- Co-investment opportunities (case by case basis)

- Fund stakes ranging from $1-100M (exceptions can apply)

How Does Palico's Secondary Marketplace Work?

What documents do I need to facilitate the sale?

We recommend having the following documents listed below to optimize the sales process:

Mandatory documents:

- Quarterly Report

- Financial Statements

- Capital Account Statement

Additional documents:

- Subscription Agreement

- Limited Partnership Agreement (LPA)

- Private Placement Memorandum (PPM)

Secondary buyers have the option to browse any secondary sales opportunities listed on the platform. Once an opportunity of interest is identified, the buyer can then request access to the sellers virtual data room to review documents to reach the seller through Palico’s encrypted messaging module.

- Term Sheet

- Sales and Purchase Agreement

- Transfer Agreement

While legal paperwork will be finalized offline, supplemental documents may be hosted in Palico’s virtual data room as needed.

Security / Data Protection

Palico’s platform combines technological excellence along with regulatory compliance. We continuously improve the platform to ensure the security and confidentiality for all of our users.

Security and Data Protection:

Palico is a cloud-based platform and complies with the industry-standard data security protocols. Our network and infrastructure use several security layers (encryption, authentication, authorization) to guarantee the confidentiality and integrity of all recorded and exchanged data. All security layers are based on widely used and approved protocols in the industry and comply with ISO 27001 certification.

Confidentiality:

Palico offers a virtual data room to share confidential information with selected counterparties. The data room’s access is granted by the seller (in the case of a secondary sale) or by the GP (in the case of fundraising) for chosen requesters.

Palico also provides an end-to-end encrypted messaging module in order to negotiate and discuss transaction details privately.

Anonymity:

Palico is designed to maintain the anonymity of all LP members on the platform:

- Palico respects the LP’s preference to remain anonymous on the platform.

- At the sellers discretion, their identity can be kept confidential up until the LOI stage.

- In the event the LP selling a secondary fund stake the identity of the seller is kept confidential at the discretion of the LP but does have an obligation to reveal their identity once the process gets to the LOI stage of a secondary sale.

Fairness:

The marketplace is controlled and overseen by our internal compliance team. The compliance team thoroughly monitors member activity to ensure that no member is misusing the information available online.

Transparency and Standardization:

Palico is built on the premise of providing a level-playing field to all its members on the platform. It does so by giving all its members’ access to the same information presented in a standardized form for all investment or sale opportunities available on the marketplace

PALICO, THE PE MARKETPLACE

For Secondary Sellers

We provide investors seeking liquidity for their LP stakes access to motivated secondary buyers — all within a standardized process